Stripe’s 2023 Annual Letter: Key Highlights for Ecommerce Businesses

Stripe, a leading online payment processor, recently released its 2023 annual letter, providing insights (some of which are quite fascinating) into the company’s performance and the broader ecommerce landscape. Of particular interest are some key stats, namely that Stripe’s payment volume surpassed $1 Trillion! This represents a 25% year on year increase for the payment processor. Also that there were more than 300 millions transactions processed on Black Friday/Cyber Monday, clocking up a staggering $18.6 billion!

This blog post highlights some of the key takeaways that may be of interest to ecommerce businesses and clients of accounting firms on the Gold Coast and in Australia.

Ecommerce Growth and Stripe’s Performance

In 2023, the collective payment volume of businesses running on Stripe surpassed $1 trillion, representing a 25% year-over-year increase. This growth outpaced the overall US ecommerce industry, which grew by 7.6% during the same period. Stripe’s payment volume now accounts for approximately 1% of global GDP.

The company reported being robustly cash flow positive in 2023 and expects to maintain this position in 2024, allowing for long-term investments and providing stability for its customers.

Optimising Checkout Experiences

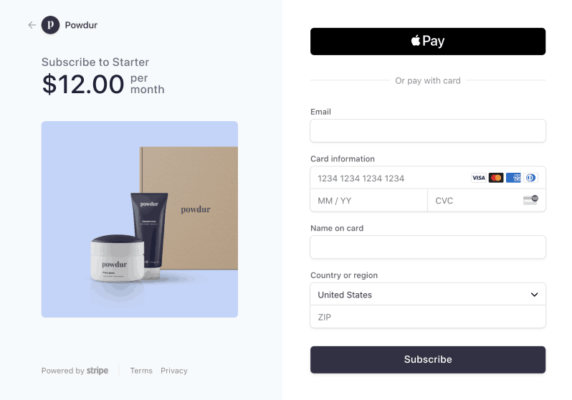

Of particular interest to any business which utilises any kind of e-commerce functionality, was that Stripe emphasises the importance of optimising checkout experiences to reduce cart abandonment rates, which can reach up to 70% for online shopping carts. The company has implemented over 100 optimisations, ranging from pre-built payment surfaces to flexible UI components, to improve conversion rates.

For example, Slack saw a conversion uplift of more than 3% by upgrading to Stripe’s optimised UIs, while Tokyu Corporation experienced a 20% increase in conversion after implementing Stripe’s solutions.

(Editor’s note: It is our opinion that Stripe provides the best ecommerce conversion optimisation of any other online payment processor, particularly being much better than a typical bank processor. Their checkout and payment process is simple and fast, and typically a much better option than for instance, Paypal, although it could be argued that it is worth also including Paypal as a payment option, because of Paypal’s very rigorous refund capability which gives nervous purchaser’s a sense of comfort, if they are not already familiar with your company’s trustworthiness.

Example of Stripe Checkout window:

Stripe is also easily integrated with highly optimised shopping cart platforms such as Samcart, Shopify and ClickFunnels.)

Revenue and Finance Automation

Stripe’s Revenue and Finance Automation (RFA) suite, which includes Billing, Tax, and Revenue Recognition, helps businesses orchestrate their overall financial logic. The suite is being used by hundreds of thousands of businesses, and its annual revenue run rate is expected to surpass $500 million in the next year.

Companies like Roblox, Figma, OpenAI, Atlassian, and Nasdaq are among those using Stripe’s RFA products.

Startup Formation and AI Companies

Despite a tighter funding environment, Stripe has witnessed record startup formation, with entrepreneurs focusing on monetising faster and enabling profitable growth. Startups founded in 2022 were 60% more likely to start collecting revenue within their first year and 57% more likely to process $1 million within their first year compared to those founded in 2019.

The influx of AI companies onto Stripe grew significantly in 2023, with twice as many AI companies going live compared to 2022. Aggregate revenue from AI companies grew by 249% in 2023.

Reliability and Engineering Practices

Stripe emphasises the importance of reliability in the payments industry and has implemented robust engineering practices to ensure high availability. During the Black Friday/Cyber Monday 2023 period, Stripe maintained uptime in excess of 99.999% while processing more than 300 million transactions and $18.6 billion in total volume.

The company employs a rigorous deployment process involving extensive testing, incremental rollouts, and continuous monitoring to detect and mitigate issues promptly.

| Key Metric | Value |

|---|---|

| Stripe’s Payment Volume in 2023 | $1 trillion (25% year-over-year increase) |

| Stripe’s Share of Global GDP | Approximately 1% |

| Typical Online Shopping Cart Abandonment Rate | Around 70% |

| Slack’s Conversion Uplift with Stripe’s Optimised UIs | More than 3% |

| Tokyu Corporation’s Conversion Increase with Stripe | 20% |

| Stripe’s RFA Suite Annual Revenue Run Rate (Expected) | $500 million+ |

| AI Companies’ Revenue Growth on Stripe in 2023 | 249% |

| Stripe’s Uptime During Black Friday/Cyber Monday 2023 | Excess of 99.999% |

| Transactions Processed During Black Friday/Cyber Monday 2023 | More than 300 million |

| Black Friday/Cyber Monday 2023 Volume | $18.6 billion |

Stripe’s annual letter provides valuable insights into the company’s performance, the ecommerce landscape, and emerging trends in areas such as AI, clean energy, robotics, and farming. By staying informed about these developments, ecommerce businesses and their accounting advisors can better navigate the evolving digital economy and capitalise on new opportunities.

Here’s a Stripe tutorial video for 2024 if you’re not familiar with Stripe:

For more information, you can download the Stripe Letter here: https://ppl-ai-file-upload.s3.amazonaws.com/web/direct-files/506879/317ff2b5-e6ee-4135-9882-aa70fdc03b0c/Stripe_2023_annual_letter.pdf

If your business needs assistance in understanding ecommerce financial reporting and how it intergrates into your accounting software reports, please contact the leading Gold Coast (Varsity Lakes) Accountants KeyPoint Accountants here.